:::Issue #4. Why are you receiving this? You want to be in a good place. This is where I share educational content and practical tips on personal finance, so you can get to your good place, wherever that maybe:::

👋🏼 Hello wealth builders!

Welcome to the fourth issue of the hellogoodplace newsletter.

It’s hard to believe we’re already a month into 2021, and it was quite the January to remember. The meteoric rise (and subsequent fall) of GameStop shares dominated the headlines. While I didn’t participate and become an instant GameStop millionaire, I did learn a new emoji lingo:

💎 🤲 : diamond hands represent traders who are willing to hold their investments indefinitely and stomach great volatility

🧻 🤲 : paper hands represent traders who sell their investments too quickly, losing out on gains

For a quick recap of why $GME stock rose, and how it became an epic battle between the billion dollar hedge funds vs a group of traders on the reddit forum called r/wallstreetbets, check out my video here.

Both 💎 🤲 and 🧻 🤲 seem awfully taxing on the mind and are terrible ways to invest over the long run. So I’m suggesting a new emoji lingo: 🌎 🤲 .

The earth hands represent investors that hold a globally diversified portfolio, with an overweight to companies that are doing good for the environment and society (ESG). This type of portfolio reduces volatility, sparing you from the emotional rollercoaster from extreme highs and lows of individual stocks. The reduced volatility will lead to an increased likelihood that you won’t sell your investments prematurely and miss out on gains. Plus, the overweight to ESG stocks will make you feel warm and fuzzy knowing that your investments are aligned with your values.

√ Win

√ Win

√ Win

🌎 🤲

What I’ve been up to:

After formalizing and posting on a more regular basis starting in December, the number of my followers DECREASED. I’m not going to lie, that was disappointing. But I kept it up all month, including adding videos to IGTV. I’m happy to share that my Instagram account is slowly but surely, growing!

I made a guest appearance on Dari TV, a Youtube channel run by Prof Hannah Jun of Ewha University in Seoul, Korea. Scheduling a time to record the video can be tricky when someone is 16+ hours ahead of you, but it was great to catch up with Hannah (we are friends from our University of Michigan days #goblue). To hear our conversation about doing good and doing well by incorporating sustainable investing to your portfolio, check out the video below.

Backdoor Roth IRA Month

February is backdoor Roth IRA month in my household - and it should be in yours too.

Tax savings through a Roth IRA can add up to hundreds of thousands of dollars, and I recommend all high earners to take advantage of it.

Check out my blog post The Mighty Roth IRA to see details

High income earners are prohibited from making direct contributions to a Roth IRA, and you also do not get a tax benefit for contributing to a traditional IRA. Tying together a couple of loopholes on both traditional and Roth IRA rules, however, high earners can make an indirect contribution to a Roth IRA.

Check out my blog post Enter the backdoor Roth IRA for the two-step backdoor process

February is a particularly good month to make your backdoor Roth IRA contribution, because by mid to late February, you should have everything you need to file your 2020 taxes.

If you are owed a refund from the IRS, file your tax return as soon as possible to get your refund, and use it to fund your Roth IRA!

If you owe the IRS money, review your cash holdings to set aside what you owe, and use what you have left to make your Roth contribution. If you don’t have enough to make the maximum contribution now, look at your cash over the next 12 months (2021 Roth contributions are due 4/15/22) and plan ahead.

Other reasons February is Roth IRA month:

Many high earners get their bonus in the first quarter of the year. Use your bonus to fund your Roth IRA.

I’ve found that the most common purchase period for ESPP is February/March and August/September, therefore if you are lucky enough to work for an employer that offers an ESPP, use your recently purchased shares (or shares from a previous ESPP that are eligible for a qualified disposition) to fund your Roth IRA.

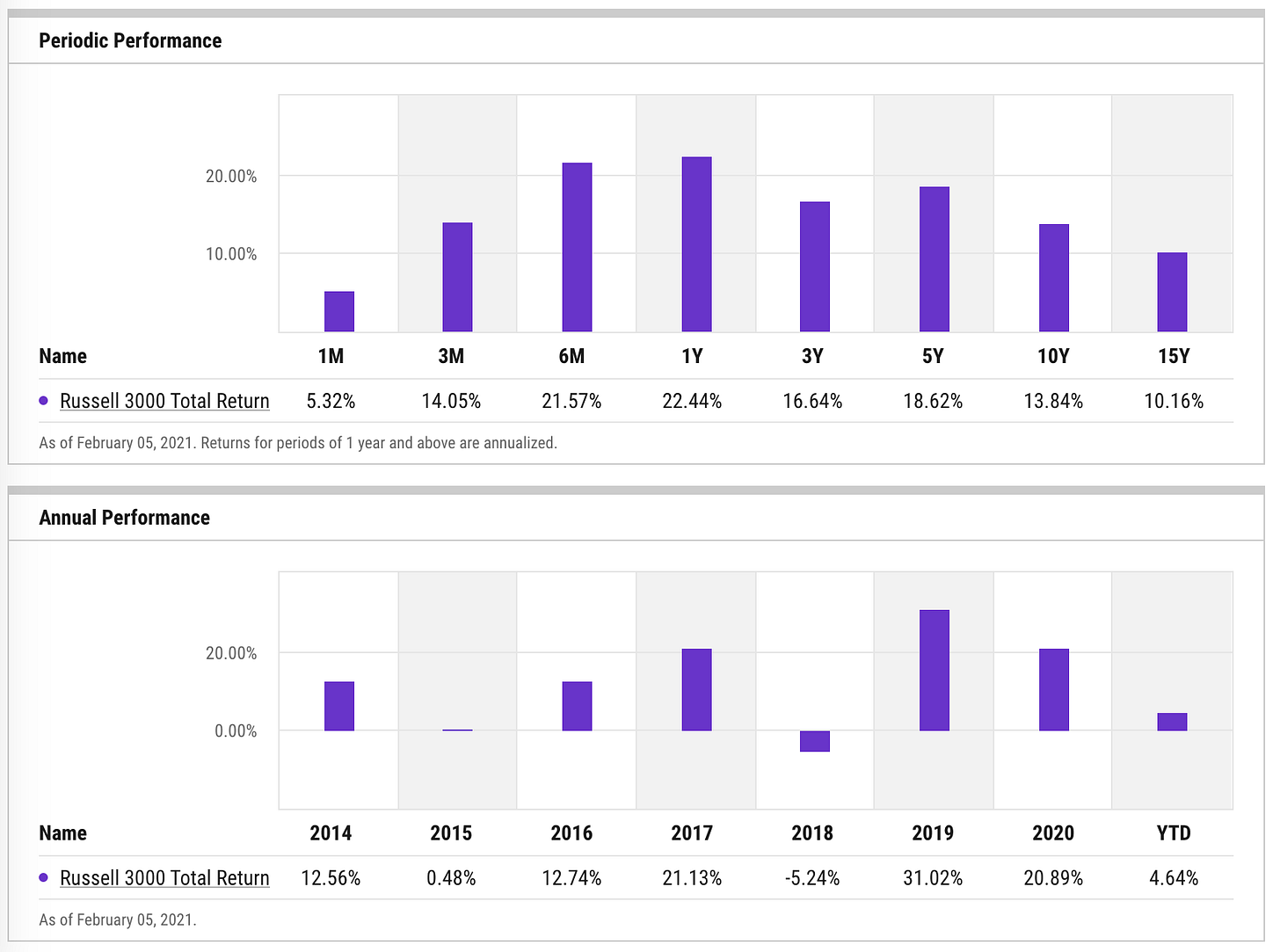

Yes, you have until 4/15/22 to make your Roth IRA contribution. Why should you contribute now? Because the earlier you contribute, the earlier you can invest. The US stock market (Russell 3000) was up roughly 20.89% in 2020, and 31.02% in 2019, and has averaged almost 12% per year over the last 40 years1. By waiting to invest a year later, you are missing out on growth.

Make February your Roth IRA month starting this year.2

To being in a good place,

Daniel

hellogoodplace.com

Twitter: @profdlee

Instagram: @hellogoodplace

Youtube: Monday Monday with Prof DLEE

Source: YCharts. Russell 3000 total returns (reinvesting dividends) averaged 11.84% from 1980 - 2020. Russell 3000 was up 31.02% in 2019, and 20.89% in 2020.

Past performance is not indicative of future returns. Investments may lose money.

Content is for education only. Not advice. Consult an attorney or tax professional regarding your specific legal or tax situation.